The Patek Philippe Calatrava Ref. 96, introduced in 1932, represents a significant moment where German design philosophy transformed Swiss watchmaking. This timepiece embodied Bauhaus principles with its clean lines and functional elegance, establishing a new standard for refined dress watches that continues to influence the market today.

Historical Performance & Market Data

Looking at auction data from the past decade, early Calatrava Ref. 96 models have shown average annual appreciation rates of 8-12%, outperforming the S&P 500 in several 5-year periods. For example, a well-preserved Ref. 96 that sold for approximately $12,000 in 2010 now regularly fetches $25,000-$35,000 at major auction houses – though with significant variation based on condition, provenance, and rarity.

Comparative Performance

Watch Model/Asset 10-Year Avg. Appreciation Liquidity Rating Market Volatility

Calatrava Ref. 96 (1932-1945) 8-12% Moderate Low

Calatrava (Modern Production) 0-3% High Moderate

Patek Nautilus Ref. 5711 15-20% Very High High

Rolex Daytona Ref. 116500 10-15% Very High Moderate

Fine Art (Blue Chip) 7-9% Low Moderate

Gold 4-6% Very High High

It’s crucial to note that not all Calatravas offer equal investment potential:

- Early Ref. 96 models (1932-1945) with sector dials have shown the strongest appreciation

- Ref. 570 (the larger 35.5mm variant) from the 1940s and early 1950s has become increasingly sought-after

- Modern production Calatravas typically experience initial depreciation before potentially stabilizing

Current Market Trends (2025)

Several factors are currently influencing the vintage Calatrava market:

- Wealth Redistribution: The ongoing shift of wealth to younger collectors has increased interest in understated designs over flashier sports models, benefiting the Calatrava’s refined aesthetic.

- Return to Classicism: Following the 2021-2023 sports watch bubble, collectors are pivoting toward classical dress watches with enduring design principles.

- Material Premiums: In response to inflation concerns, precious metal Calatravas (particularly platinum versions) are commanding significant premiums.

- Authentication Technology: Recent advances in material analysis have improved authentication capabilities, reducing counterfeit risks and strengthening buyer confidence.

The first quarter of 2025 has already seen three notable Calatrava sales, including a rare Ref. 96 with black sector dial that achieved $78,500 at Phillips Geneva—nearly double its high estimate.

Risk Assessment & Portfolio Considerations

Watch investing carries specific risks that potential collectors should understand:

- Liquidity constraints: Unlike securities, watches can take months to sell at optimal prices

- Authentication challenges: The vintage market requires expert knowledge to avoid sophisticated replicas

- Maintenance costs: Periodic servicing ($1,000-$3,000 every 5-7 years) impacts net returns

- Insurance expenses: Typically 1-2% of appraised value annually

- Market cyclicality: Watch investing typically follows 7-10 year cycles, with periods of stagnation between growth phases

Financial advisors generally recommend limiting alternative assets like watches to 5-10% of an investment portfolio. Watches should complement traditional investments rather than replace core positions in equities, bonds, and cash equivalents. The typical holding period for investment-grade watches is 7-15 years to maximize returns while minimizing transaction costs.

Acquisition & Exit Strategy Guide

For First-Time Buyers

- Education First: Before purchasing, spend 3-6 months studying the market through auction results (Christie’s, Phillips, Sotheby’s) and specialist publications (Hodinkee, Revolution)

- Build Relationships: Establish connections with 2-3 reputable dealers who specialize in vintage Patek Philippe

- Authentication Protocol: Request detailed macro photographs of dial, movement, and case hallmarks Verify serial numbers against Patek Philippe archives Consider third-party authentication for significant purchases

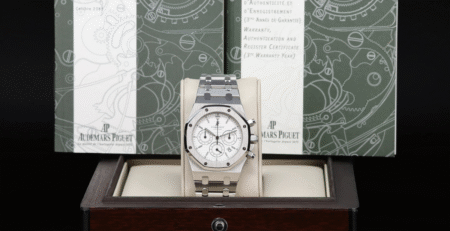

- Documentation Checklist: Original papers and certificate of origin Service history from authorized service centers Previous auction provenance (if applicable) Original box and accessories

Exit Strategy Optimization

The most successful sellers typically follow this pattern:

- Market Timing: Plan sales during peak auction seasons (May/November)

- Pre-Sale Preparation: Professional photography and condition assessment from established auction houses

- Consignment Strategy: Choose between auction houses based on their recent performance with similar pieces

- Reserve Setting: Work with specialists to set appropriate reserves (typically 70-80% of expected sale price)

The Bauhaus-influenced Calatrava represents a fascinating intersection of design history and investment potential, but requires disciplined approach and specialist knowledge to navigate successfully.

Planning Your Investment

When considering adding a Calatrava to your portfolio, ask yourself:

- What holding period aligns with your financial goals?

- Do you have the expertise to authenticate pieces, or access to advisors who do?

- How will you ensure proper storage and maintenance?

- What percentage of your alternative asset allocation is appropriate for watches?

Further Resources

- Market Analysis: The Knight Frank Luxury Investment Index provides quarterly updates on watch market performance

- Authentication Guidance: The Patek Philippe Encyclopedia by Osvaldo Patrizzi offers detailed authentication markers

- Portfolio Integration: “Tangible Investments in an Intangible World” (Journal of Wealth Management, Winter 2024)

- Expert Consultation: For personalized guidance on specific Calatrava references, contact us at prestigeworldwide.luxury

What role do you see the Calatrava playing in your diversified watch portfolio? How might current market conditions affect your vintage watch acquisition strategy?