The pre-owned luxury watch market has evolved from shadowy dealer networks to a $24.38 billion global industry. While growth projections vary by analyst, ranging from $42-$48 billion by 2030, all major research firms predict strong double-digit compound annual growth rates (Grand View Research, McKinsey, BCG). But here’s the reality check: after 12 consecutive quarters of price declines, the days of easy money are over.

I’ve watched the market swing from pandemic-era euphoria to today’s more rational landscape. This reset creates genuine opportunities, but only for those who understand the rules.

The Market Growth with Growing Pains

The Big Picture: Pre-owned watch sales hit $22 billion in 2021, representing nearly one-third of the $75 billion luxury watch market (BCG Global Luxury Report). Between 2018 and 2023, top models from Rolex, Patek Philippe, and Audemars Piguet appreciated roughly 20% annually, crushing the S&P 500’s 8% return (BCG analysis).

The Correction: Those same indices show Q1 2025 posting a -0.4% decline (Morgan Stanley/WatchCharts), the smallest drop in three years but still marking a year of continued contraction. The speculative bubble has burst, leaving behind a more mature market.

Notably, regional performance varies: North American markets have shown more resilience than European counterparts, with Asian markets displaying the highest volatility during the correction period.

What Changed: Online platforms like Chrono24, WatchBox, and Watchfinder democratized access and information. BCG projects these channels will handle 60% of secondary sales by 2026. Rising retail prices and limited availability drove buyers to pre-owned pieces, where popular models still command premiums; a steel Daytona retailing for $14,800 trades for $24,000-$38,500.

Key Timing Indicators

It is always about recognizing patterns when it comes to smart buying. Here’s what to watch:

Seasonal Patterns

Prices typically spike around major auctions (spring and fall) and holidays when collectors compete aggressively. The sweet spot? Late summer and early autumn, when demand cools.

Economic Cycles

Recessions and liquidity crunches force sellers to accept lower prices. With interest rates elevated and discretionary spending pressured, we’re potentially in such a window now.

Brand Momentum

Recent data shows uneven performance: Rolex (+0.4% QoQ), Audemars Piguet (-0.3%), and Patek Philippe (-1.5%) outperformed LVMH brands (-3.2%) according to Morgan Stanley’s Q1 2025 luxury watch index. Mid-tier brands like Cartier (-1.1%) and Omega (-1.0%) showed surprising resilience (WatchCharts data).

Hype Cycles

Discontinued or wait-listed models command premiums, but timing matters. Buying at peak hype guarantees overpaying, patience rewards better prices.

Strategic Buying for the Next Generation

1. Hunt During Market Lulls

The current environment, with prices down across most segments, represents a potential opportunity. Sellers need liquidity, creating room for negotiation that didn’t exist during the 2020-2022 boom.

2. Look Beyond the Headlines

While everyone chases steel Rolexes, consider underappreciated segments:

- Omega Speedmaster Professional: Genuine moon history at accessible prices

- Cartier Tank or Santos: Timeless design with loyal following

- Breitling series: Aviation heritage without the premium

These models often trade below retail yet maintain strong collector interest.

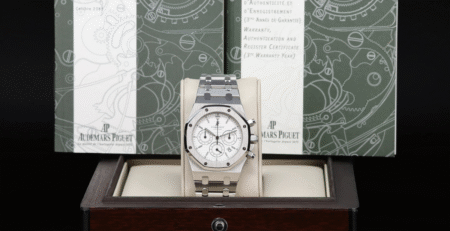

3. Embrace Certified Pre-Owned Programs

Authentication matters; counterfeits are sophisticated. Rolex’s CPO program generated $100 million in Q1 2025 sales (Business of Fashion analysis), proving market acceptance. The premium over grey-market pieces pays for peace of mind.

4. Master the Fundamentals

- Buy complete sets: Box, papers, and service history add significant resale value

- Use pricing tools: WatchCharts historical data provides negotiating leverage

- Set walk-away prices: Emotional purchases lead to overpaying

- Choose reputable sources: Established dealers and platforms offer buyer protection

5. Think in Decades, Not Quarters

BCG’s analysis shows that luxury watches outperformed art, wine, and handbags over the past decade, appreciating 7% annually. But short-term flippers typically lose money when hype cycles reverse. Buy pieces you genuinely enjoy wearing—the psychological dividend makes market volatility bearable.

Exit Like a Pro

Timing Your Sale

Sell into strength during limited-edition announcements, anniversaries, or auction seasons. Monitor market indices and social media sentiment, when prices trend upward, consider listing.

Preparation Pays

Complete service history: Recent authorized service adds value and buyer confidence

Full documentation: Original box, papers, and spare links are essential

Professional photos: Quality presentation commands better prices

Platform Selection

Peer-to-peer forums: Highest net proceeds but require trust and expertise

Marketplaces (Chrono24, WatchBox): Lower fees than auctions, wider reach

Auction houses: Premium pricing for rare pieces but higher fees and longer timelines

Avoiding Costly Mistakes

Authentication Risk: Always verify through professional appraisal or CPO programs. Polished cases and replaced parts significantly diminish value.

Market Volatility: Diversify across brands and models. The 12-quarter decline reminds us that watches aren’t guaranteed investments.

Liquidity Constraints: Popular references move quickly; niche models may take months to sell. Watches shouldn’t replace emergency cash reserves.

Hidden Costs: Factor in dealer commissions (5-15%), shipping, insurance, and servicing expenses (every 5-10 years).

Patience and Perspective

The pre-owned watch market’s trajectory, $24 billion today, with analyst projections ranging from $42-$48 billion by 2030, reflects genuine collector enthusiasm, not speculative mania. For tech-savvy professionals entering the market, current conditions offer opportunities unavailable during the recent bubble.

The winning strategy: Buy quality pieces you love, at fair prices, with a long-term perspective. Leverage market lulls, embrace CPO programs, and stay connected with the collector community.

A well-timed purchase today may become tomorrow’s heirloom and prove to be a sound investment thesis as well.

Sources: Grand View Research, Morgan Stanley/WatchCharts, BCG Luxury Watch Report, Business of Fashion, Quill & Pad market analysis