Did you know most luxury watches lose 20–50% of their value immediately after purchase, but a handful of iconic models have skyrocketed 300% or more in just ten years?

With traditional investments showing unpredictable returns, savvy collectors increasingly turn to luxury watches, doubling as elegant timepieces and formidable wealth preservation vehicles.

Understanding Value Retention in Luxury Timepieces

For collectors focused on value-retaining horology, understanding the fundamental difference between watches that appreciate, retain value, or depreciate is crucial before making any significant purchase.

It’s crucial to understand that most watches, even from respected manufacturers, fall into the depreciation category. Only a small percentage truly retain their value, and an even smaller subset appreciates meaningfully. Identifying these exceptional timepieces requires knowledge, research, and often, patience.

The Three Value Trajectories of Luxury Watches

Value retention refers to a timepiece maintaining approximately the same market value over time, adjusting for inflation. A watch that sells for roughly the same price you paid for it years later has successfully retained its value.

Appreciation occurs when a watch’s market value increases beyond its original purchase price, outpacing inflation. This is what investors actively seek—watches that not only hold their value but also grow it.

Depreciation is the reduction in a watch’s market value over time, the fate of most luxury goods and, indeed, most watches. Even among prestigious brands, many models lose 20-40% of their value shortly after purchase.

The difference between these categories can be dramatic. Consider three watches purchased in 2015 for $10,000 each:

– The depreciated watch might be worth just $5,000-6,000 today

– The value-retaining watch would still command close to $10,000-11,000

– The appreciating watch could now be valued at $15,000, $25,000, or in rare cases, significantly more

Why Value Retention Matters for Watch Collectors

Even if you’re collecting purely for personal enjoyment, value retention remains relevant for several compelling reasons:

1. Financial prudence. Luxury watches represent significant expenditures, often ranging from thousands to hundreds of thousands of dollars. Understanding which models better retain their value helps ensure your passion doesn’t become a financial burden.

2. Collection evolution. Most enthusiasts find that their tastes and preferences evolve. Watches that hold their value provide flexibility, allowing you to sell or trade pieces without significant losses as your collection matures.

3. Legacy planning. Many collectors view their timepieces as potential heirlooms to be passed down through generations. Watches that maintain their value become meaningful assets in addition to their sentimental worth.

4. Protection against market volatility. In uncertain economic times, certain luxury watches have demonstrated remarkable stability compared to other asset classes, offering a form of portfolio diversification.

When I first started collecting, I made the rookie mistake of buying what I thought was”trendy” rather than timeless. That limited-edition fashion brand collaboration seemed exciting at the time, but trying to sell it just two years later taught me a painful lesson about the difference between hype and lasting value.

Key Factors That Determine a Watch’s Investment Potential

In our upcoming articles, we’ll explore in detail the specific factors that enable certain watches to defy the typical depreciation curve. Here’s a preview of what we’ll cover:

Brand Heritage and Market Position

The reputation and positioning of a watch brand play a crucial role in determining value retention. Established brands with rich histories like Rolex, Patek Philippe, and Audemars Piguet consistently outperform newer or less prestigious brands (Phillips Auctions, 2024). These heritage manufacturers have proven their longevity and commitment to craftsmanship over decades or even centuries.

Rarity and Production Numbers

Limited production runs, discontinued models, and naturally scarce timepieces often command premium prices in the secondary market. According to data from Morgan Stanley & LuxeConsult (2024), Rolex produces approximately 1.2 million watches annually, while Patek Philippe makes fewer than 70,000—a key factor in Patek’s higher average appreciation rates.

Iconic Design and Timeless Appeal

Watches with classic designs that transcend short-term trends tend to maintain their value better than those that chase current fashion. Models like the Rolex Submariner, Omega Speedmaster, and Cartier Tank have proven their enduring appeal across generations, as evidenced by consistent demand in both auction and private sales (Hodinkee Market Report, 2024).

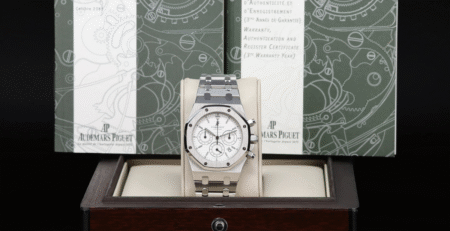

Condition, Originality, and Documentation

The physical state of a watch significantly impacts its value. According to Bob’s Watches (2025), timepieces in excellent condition with all original parts, minimal wear, and complete with original boxes, papers, and accessories command 30-60% higher prices than those that have been heavily worn, modified, or lack documentation.

Material Quality and Craftsmanship

The inherent quality of materials and construction influences a watch’s ability to maintain value. Exceptional craftsmanship, in-house movements, and high-grade materials contribute to both the longevity of the timepiece and its appeal to discerning collectors.

The Current Luxury Watch Market in 2025

The luxury watch market continues to evolve, with global valuation reaching approximately $45 billion in 2023 and projected to grow at a CAGR of 5.8% to reach $72.13 billion by 2030, according to Mordor Intelligence (2025). Recent market data shows several significant trends affecting value retention:

Stabilization of the pre-owned market after the pandemic-driven volatility, with auction data showing a 13% drop in overall sales but a 2% increase in value for watches selling over 1 million Swiss francs (Mercury Project Hammertrack Report, 2024)

Growing demand for classic models with proven track records, particularly from established brands with heritage value

Increasing interest from younger collectors seeking both diversification and status, with Sotheby’s reporting that 40% of their watch clientele is now under 40 years old

Rising importance of sustainability in manufacturing practices and brand ethics

Shift towards smaller case sizes. (37-39mm) reversing the oversized watch trend that dominated the 2010s, according to SwissWatchExpo’s 2025 market analysis.

Watches That Have Proven Their Investment Value

In future installments, we’ll provide detailed analyses of specific watches that have demonstrated exceptional value retention or appreciation, including:

Rolex Daytona. The stainless steel ref. 116500LN has appreciated from its retail price of $12,400 to over $35,000 on the secondary market since its introduction in 2016, according to WatchCharts data (2025).

Patek Philippe Nautilus. After Patek announced the discontinuation of the iconic 5711 model in 2021, secondary market prices surged to over $170,000 (from a retail price of approximately $30,000).

Audemars Piguet Royal Oak.The “jumbo” ref. 15202ST celebrated its 50th anniversary in 2022, with vintage pieces from the 1970s now commanding six-figure sums at auction.

Omega Speedmaster “Moonwatch”. While more accessible, limited editions like the “Snoopy Award” models have seen significant appreciation, with the 2015 Silver Snoopy edition now trading at 5-6 times its original retail price.

Cartier Tank. Perhaps the most enduring dress watch design in history, vintage Tank models in good condition have steadily appreciated while maintaining timeless appeal.

By examining these success stories, we’ll extract valuable lessons for identifying tomorrow’s most valuable timepieces.

What’s your experience with watch collecting? Have you ever sold a watch for more than you paid for it, or suffered an unexpected loss on what you thought was a good investment?

Share your stories in the comments!